Malta: a prime destination for wealth and citizenship amidst global tax changes

Malta: A Prime Destination for Wealth and Citizenship

As governments around the world tighten tax regimes, many high-net-worth individuals (HNWIs) are increasingly seeking out jurisdictions that offer more favourable tax environments and opportunities for citizenship by investment (CBI). Among European Union countries, Malta stands out as one of the few remaining with an active citizenship by investment programme—offering both citizenship and advantageous tax conditions.

Citizenship by Investment: Malta’s Programme

Malta’s Individual Investor Programme (IIP), though stringent in its due diligence and regulatory processes, provides a streamlined path to Maltese citizenship for HNWIs and their families. Malta’s citizenship by investment scheme requires applicants to make significant financial commitments, which typically include:

A minimum donation of €750,000 to the National Development and Social Fund (with the option to reduce this to €600,000 if they commit to 36 months of residency).

Investment in property—purchasing a property worth at least €700,000 or entering into a five-year lease agreement for at least €16,000 annually.

A philanthropic contribution of €10,000 to a local charity or NGO.

Malta’s Low-Tax Environment for Investors

Malta not only attracts foreign investors through its CBI programme, but it also provides substantial tax incentives. In contrast to other European jurisdictions, Malta has remained competitive by offering one of the most attractive tax environments in the EU:

No VAT on Property Transactions: Unlike many European countries, Malta does not impose VAT on the purchase of immovable property. This can save buyers considerable sums, especially for high-value real estate investments.

No Annual Property Tax: Property owners in Malta benefit from no annual property or wealth tax. Once purchased, properties do not incur additional annual tax liabilities, unlike countries like France, Spain, or the UK.

No Inheritance Tax: Heirs of Maltese property do not pay inheritance tax on their inherited assets. While a 5% stamp duty applies when ownership changes, there is no separate inheritance tax, making it easier to transfer wealth to future generations without additional financial burdens.

Why Malta? Political Stability, Prime Location and Lifestyle

In the context of global changes—such as the UK abolishing its “non-dom” status and other countries tightening tax rules—Malta offers a unique combination of tax advantages, stable governance, and a strategic Mediterranean location. Not only is the country a gateway to Europe, Africa, and the Middle East, but it also offers a high standard of living, excellent healthcare, and an English-speaking population.

Beyond these benefits, Malta remains a tax-efficient jurisdiction for global investors. The country’s tax regime ensures that foreign-source income is not taxed unless remitted to Malta, and corporate tax rates can be effectively reduced to 5% through its tax refund system.

The European Wealth Migration Trend

Countries such as the UK, France, and even Italy are experiencing an exodus of wealthy individuals as they tighten tax rules or increase levies on wealth, capital gains, and inheritances. Recent statistics show that more than 128,000 millionaires will relocate globally in 2024, many seeking refuge in tax-friendly countries like Malta. With Switzerland, Monaco, and the UAE dominating the market for the ultra-wealthy, Malta stands out as a smaller yet highly competitive alternative within the EU.

Malta’s Resilience in the Global Wealth Landscape

While nations like Italy have recently doubled their flat tax on foreign income to €200,000 per year, Malta has remained relatively consistent with its tax regime. Coupled with its citizenship by investment programme, Malta offers a balanced proposition to HNWIs looking to diversify their residency or citizenship options without the uncertainty of frequent tax policy changes.

For families seeking not only stability but a thriving business environment and lifestyle perks, Malta offers robust financial incentives. With its low property taxes, exemption from VAT, and no inheritance tax, it is a highly attractive destination.

Property and Citizenship: A Key Component

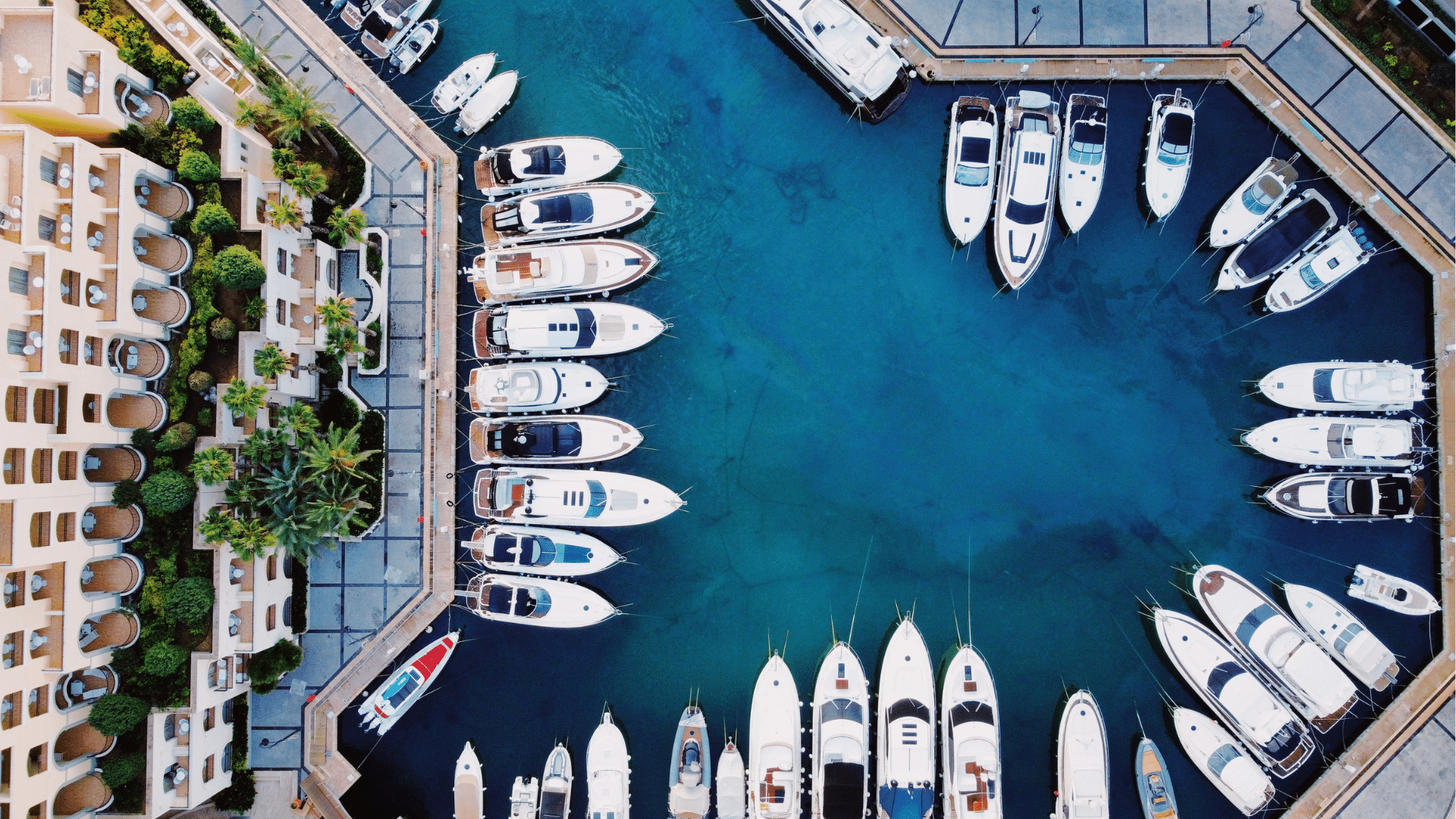

In addition to the financial requirements for the IIP, purchasing or renting a property in Malta is an obligatory part of securing citizenship. Whether you are looking to buy a luxury seafront villa or a charming apartment in one of Malta’s historic cities, our team at Christie’s International Real Estate Malta can guide you through the local property market. We collaborate with legal experts and financial advisors to provide a seamless process for those seeking to take advantage of Malta’s citizenship and residency programmes.

Our in-depth knowledge of Malta’s real estate landscape ensures that we can help you identify the perfect property to meet the CBI requirements, while also catering to your investment or lifestyle needs. Malta is more than just a tax-efficient hub, it is a beautiful, historic island that can truly be called home.

Investing in Malta’s Future

With tax regimes tightening across Europe, Malta offers a stable, attractive alternative for HNWIs seeking citizenship, residency, and a favourable tax regime. Whether you are considering relocating due to tax pressures in your home country or simply looking for a new home base, Malta offers numerous incentives that make it a top choice in today’s global wealth migration.

With no VAT on property purchases, no annual property tax, and no inheritance tax, investing in Maltese real estate can provide both financial and personal rewards. And with citizenship opportunities still available, Malta continues to attract those seeking a new home in a highly desirable, Mediterranean location.

If you are considering Malta for your next investment or relocation, Christie’s International Real Estate Malta is here to assist you through the process—from property selection to citizenship. Reach out to us today, and let us help you unlock the full potential of Malta’s offerings.